The Washington State Legislature is changing the way real estate excise taxes (REET) are calculated. This change may affect the amount of excise tax you pay depending on the sale price of your property. For sellers whose homes sell for less than $1.5 million, you will see a slight decrease in the amount of tax paid. For homes over $1.5 million or more, you will see an increase in taxes paid, and this may be a substantial increase.

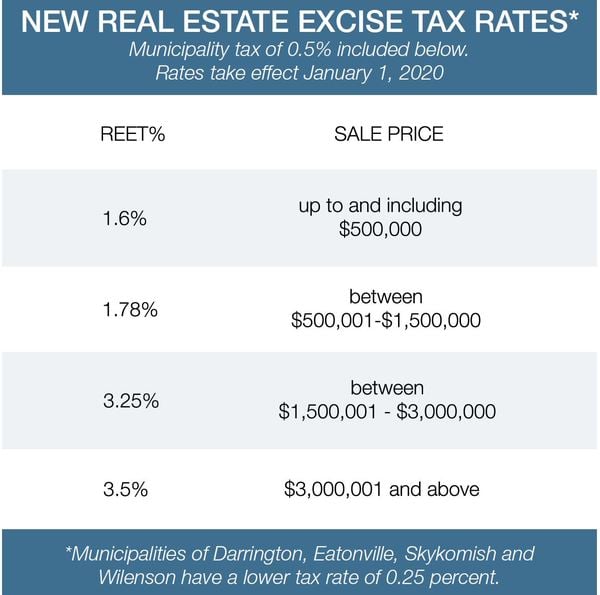

Currently, the state excise tax is 1.28 percent. Local municipalities add their excise tax on top of the state tax, with most cities in our area adding 0.50 percent, to total 1.78 percent. Effective January 1, 2020, Washington state will begin calculating real estate excise taxes based on a tiered system:

- Sales under $500,000: 1.1% tax rate (down from 1.28%)

- Sales from $500,000 to $1.5 million: 1.28% tax rate (unchanged and 1.1% marginal rate on first $500k)

- Sales from $1.5 million to $3 million: 2.75% tax rate (115% increase, but marginal rate increase means first $500k @1.1%, then $500k to $1.5M @ 1.28%)

- Sales over $3 million: 3.0% tax rate (134% increase, marginal rates in effect)

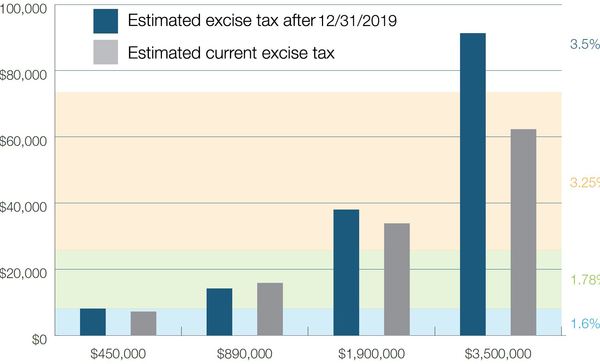

If you are thinking of buying or selling soon, now would be a great time to contact us and find out how this new legislation will affect your transaction. Whether buying or selling, knowing the effect of this excise tax could save you thousands or tens of thousands of dollars. The following graph shows you a comparison of taxes in 2019 (the gray) and after January 1st (the blue).

For more information on the real estate excise tax or on selling your home, please call me at (206) 790-0081 or email [email protected].